A quiet but significant shift has taken place in the aesthetics world.

The recent Upper Tribunal decision in the case of Illuminate Skin Clinic v HMRC is poised to reshape how aesthetic treatments are taxed — and how practitioners must justify whether their services qualify for VAT exemption.

This is not just a legal technicality. It could redefine how you document consultations, position your services, and manage your business operations going forward.

The Background: Why VAT Status Matters in Aesthetics

For years, many medical practitioners working in aesthetics have operated under the understanding that certain non-surgical treatments can be exempt from VAT, provided they are carried out by a registered medical professional and have a therapeutic purpose.

But there has always been a grey area — one that HMRC has scrutinised more closely in recent years.

Was the treatment truly for a medical or therapeutic purpose (for example, to treat migraines, hyperhidrosis, or psychological distress from scarring)?

Or was it simply to improve appearance — making it, in HMRC’s view, a taxable, cosmetic service?

The Illuminate Skin Clinic v HMRC ruling offers much-needed clarity on this question — and it’s likely to have a ripple effect across thousands of clinics nationwide.

The Case: Illuminate Skin Clinic v HMRC

Illuminate Skin Clinic, like many aesthetic providers, offered treatments such as Botox and fillers performed by qualified medical practitioners. The clinic argued that some of its services were VAT exempt because they were delivered by healthcare professionals and had therapeutic benefits.

HMRC challenged this view. They maintained that the primary purpose of the treatments was cosmetic enhancement rather than medical therapy — and therefore should be subject to VAT.

The case eventually reached the Upper Tribunal (Tax and Chancery Chamber), which overturned elements of the previous decision by the First-tier Tribunal. While it did not issue a blanket rule for all aesthetic practices, it set out stronger guidance on when exemption can and cannot apply.

The Core Principles from the Tribunal’s Findings

The tribunal established several critical points that every aesthetic practitioner must understand:

1. The “Principal Purpose” Test

VAT exemption hinges on whether the main purpose of the treatment is to address a medical or psychological condition, rather than to improve appearance alone.

If a patient presents with a diagnosed medical concern (such as acne scarring, bruxism, or body dysmorphia contributing to psychological distress), and your intervention is clinically justified, exemption may apply.

However, if the motivation is purely aesthetic enhancement — to look fresher, younger, or more defined — it does not qualify.

2. The Role of the Practitioner

Only medically registered professionals (doctors, dentists, nurses, pharmacists) working within their scope of practice can deliver treatments eligible for exemption.

Even then, the onus is on the practitioner to prove that the service had a therapeutic rationale.

Delegating or franchising under non-medical teams without clear clinical oversight can complicate exemption status considerably.

3. The Importance of Documentation

This ruling underscores that robust clinical documentation is non-negotiable.

You must clearly record:

- The clinical diagnosis or condition being addressed

- The therapeutic rationale for treatment

- The assessment and consent process

- The registration status of the practitioner performing the treatment

In essence, your clinical notes must demonstrate that the procedure served a medical purpose, not simply a cosmetic one.

4. No Blanket Exemption

The decision reinforces that VAT exemption is not automatic just because a treatment is performed by a medical professional.

Each treatment, and indeed each patient case, must be assessed individually.

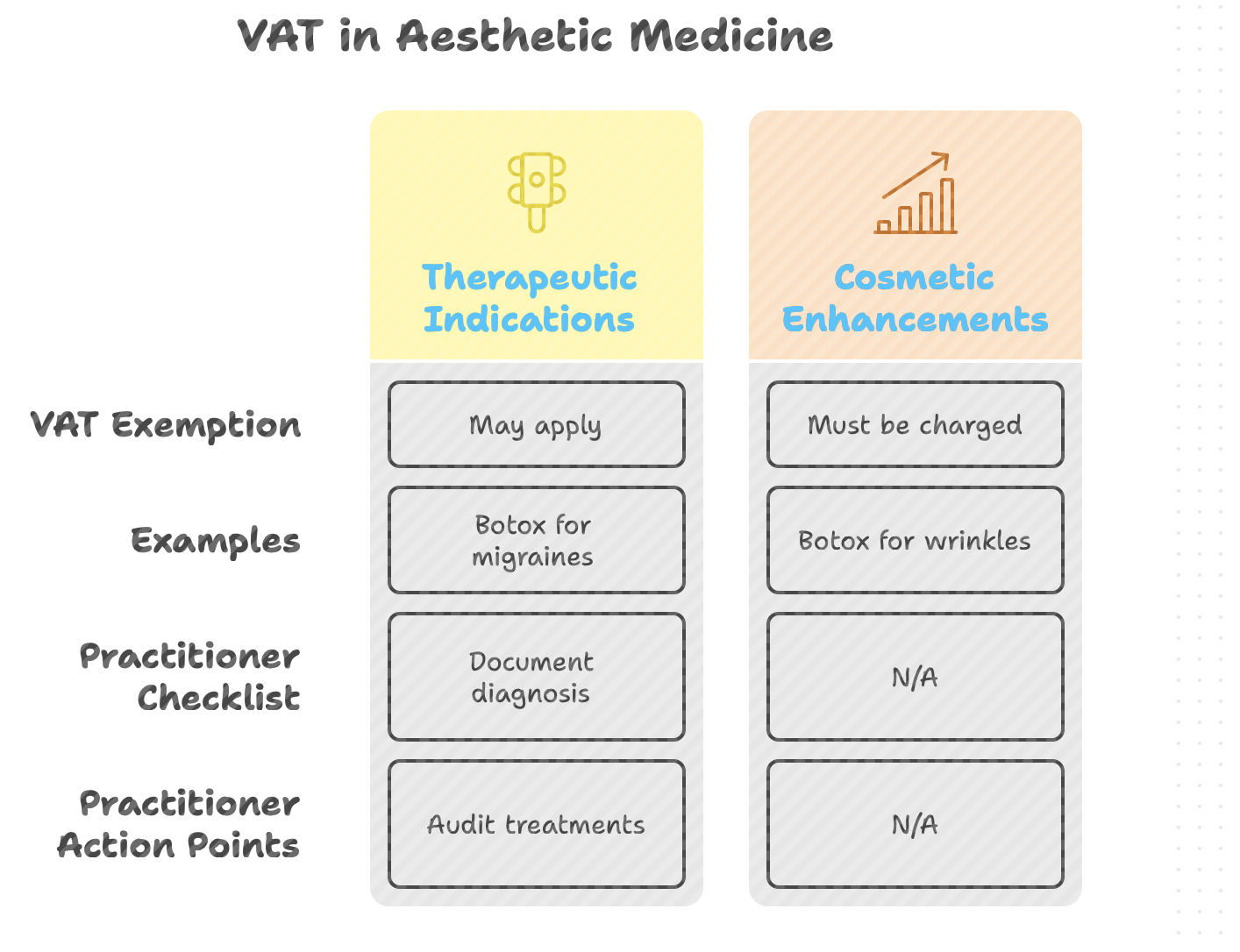

This means one practitioner could deliver two identical treatments — one VAT-exempt (for therapeutic indication) and one VAT-liable (for cosmetic enhancement) — depending on the patient’s diagnosis and clinical justification.

What This Means for Everyday Practice

This decision is a wake-up call for all clinicians offering aesthetic treatments.

Even if your practice has always operated under exemption, it’s time to audit your systems and tighten your protocols.

Here are the key takeaways:

1. Review Your Treatment Portfolio

Categorise your treatments into two broad groups:

- Therapeutic / Medical Purpose: e.g., Botox for migraines, bruxism, hyperhidrosis; filler for trauma-related facial imbalance or scar correction.

- Aesthetic Purpose: e.g., Botox for wrinkles, filler for volume restoration or beautification.

The former may be exempt; the latter will almost certainly not be.

2. Strengthen Your Consultation Process

Integrate diagnostic questioning into your consultations.

If a patient’s primary goal relates to self-esteem or a medically relevant condition, document this thoroughly — and ensure it’s supported by clinical reasoning.

Where appropriate, use validated assessment tools or psychological screening forms to strengthen your evidence base.

3. Update Clinical Documentation Templates

Your consultation forms, consent documents, and treatment plans should explicitly include fields for:

- Medical or psychological indication

- Practitioner registration details

- Clinical justification narrative

If you ever face HMRC scrutiny, these details will form your strongest defence.

4. Revisit Pricing and VAT Policy

If your treatments are purely cosmetic, build VAT into your pricing structure transparently.

Do not risk undercharging or retrospectively facing VAT liabilities.

Clear separation of “medical” versus “aesthetic” service lines — both operationally and in marketing materials — will make compliance far simpler.

5. Educate Your Team

Receptionists, treatment coordinators, and practice managers must also understand these distinctions.

They often communicate with patients about pricing, treatment purpose, and documentation.

A unified understanding prevents unintentional misrepresentation of your services.

The Bigger Picture: Professionalisation and Public Trust

Beyond taxation, this ruling reinforces a broader truth:

Aesthetic medicine is no longer a grey area between beauty and healthcare.

It is a regulated, medically governed field — and every practitioner must operate accordingly.

By clearly defining therapeutic intent, maintaining meticulous records, and aligning practice structures with medical standards, practitioners strengthen not only their compliance but also the credibility and reputation of the entire profession.

Final Thoughts

The Illuminate Skin Clinic v HMRC case is a landmark moment for aesthetic medicine in the UK.

It draws a sharper line between medical treatment and cosmetic enhancement, urging practitioners to operate with the clarity, rigour, and documentation expected of any other medical specialty.

If you are a clinician offering injectable or device-based treatments, this is the time to:

- Reassess your VAT policies,

- Strengthen your clinical documentation, and

- Seek specialist tax or compliance advice where necessary.

In short, the message is clear:

If it’s medical, prove it. If it’s cosmetic, tax it.

Source: Joint Council for Cosmetic Practitioners (JCCP) — “Important VAT decision could reshape aesthetic practice tax treatment” (October 2025).

Disclaimer: This article is for general educational purposes only and does not constitute financial, legal, or tax advice. Practitioners should seek independent professional guidance regarding their individual circumstances.